Explainers :

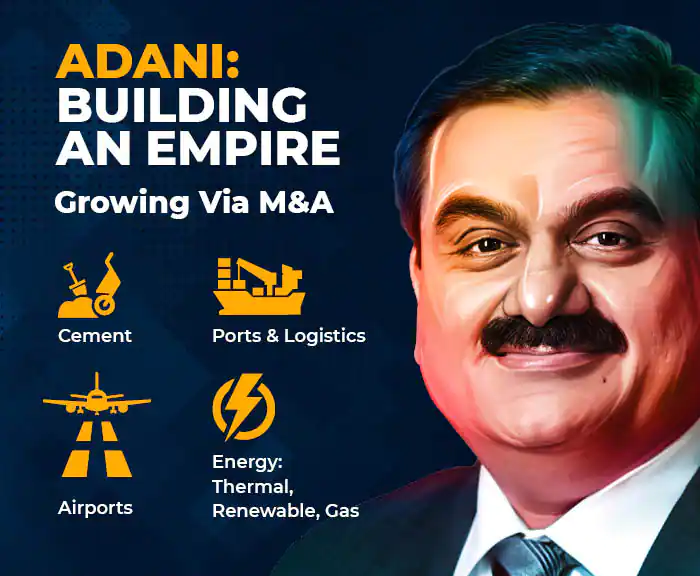

Ahmedabad-based Group is an Indian multinational conglomerate. Gautam Adani started it in 1988 as a commodity trading business with Adani Enterprises as its flagship company. Port management, electric power generation and transmission, renewable energy, mining, airport operations, natural gas, food processing, and infrastructure are among the Group's numerous businesses.

Adani Group became the third Indian conglomerate, after Tata Group and Reliance Industries, to reach US$200 billion in market capitalization in April 2022 and US$100 billion in market capitalization in April 2021, respectively. It surpassed Tata Group’s US$280 billion (INR 24 trillion) in November 2022. After short-seller Hindenburg Research made allegations of fraud and market manipulation, Adani lost more than US$104 billion in market capitalization. Due to numerous reports of questionable practices, the Adani Group has also drawn attention to other controversies. Businesses related to coal account for more than 60% of the revenue generated by the Adani Group. In 2022, the company’s total debt is $30 billion.

Listed companies

- Adani Enterprises

- Adani Green Energy

- Adani Ports & SEZ

- Adani Power

- Adani Transmission

- Adani Total Gas

- Adani Wilmar

Adani-Hindenburg: A lot has changed for the ports-to-power conglomerate in the days since US-based short seller Hindenburg Research released its damning report accusing the Adani Group of companies of stock manipulation and misusing tax havens.

- Adani Group’s combined market capitalization loss exceeds Rs 9.5 lakh crore.

- The most significant side effect is the cancellation of Adani Enterprises’ FPO.

- Second, the market capitalization of Adani Group’s listed companies continues to fall.

- Third, Gautam Adani is no longer among the top 15 richest people in the world.

- Fourth, the SEBI has begun an investigation into Hindenburg’s allegations.

- Fifth, the Reserve Bank of India has requested information on all loans made to Adani Group.

- The sixth side effect is that Credit Suisse, a global investment bank, has reduced the value of Adani Group’s bonds to zero.

Gautam Adani, the world’s richest Indian until recently, has now slipped to 22nd place on the Forbes billionaire list as a result of Hindenburg Research’s report.